Ripoduzione riservata

Article started on the 1st of May 2021

Bitcoin price is exploding. As it does every 4 years. Right now it is 57’500$. One year ago it was 8’824$ . Two years ago 5’323$. The energetic cost of mining Bitcoin is also exploding. To function the Bitcoin network requires the work of miners. Miners solve complex mathematical problems that use a lot of energy. Those problems needs to be solved just to decide which miner will be the one to write the next block in the blockchain. And whoever writes the next block earns the new bitcoin produced and the transaction fees. Writing a block in the blockchain is a trivial task if it wasn’t for this. All the extra calculations are for those useless problems. And since the Bitcoin protocol requires that a block should be written every 10 minutes, then once every 2 weeks (actually every 2016 blocks) the difficulty of the problems gets recalculated so that if in the last 2 weeks miners have been solving the problem in less then 10 minutes the problem gets worse. If it took more than 10 minutes the problem gets better. The general trend is that it gets worse. Because as time goes by faster and faster computers are available, and as time goes by the value of bitcoin rises. All this is known. I now want to show you three things:

- There is a very simple, rough, way to calculate the amount of energy used by the miners

- The energy used right now is enormous, and it will get worse;

- We should not worry.

I understand that given 1 and 2, how I can conclude 3 is going to be a hard sell. But I am confident I will be able to convince you. And yes, I do own Bitcoin, and I consider myself environmentally conscious. So let’s get going.

Calculating the Energy Used by Miners

How do we calculate the energy used by miners? In every moment there are thousands of computers that are trying to solve those mathematical problems, how much energy do they all use? The first answer is that, of course, we do not know. But we know a few things:

- The price of Bitcoin;

- The amount if Bitcoin produced for every transaction;

- The average value of the fees;

- The total value of the fees gained by the miners;

- The value in dollar terms the miners get paid every block.

The value of 5 is simply the product of (1) multiplied by (2) plus (1) multiplied by (4). If we ignore the fees right now the miners get paid for each block 6.25*57500$=359’375$. That’s 359’375$ per block. To this we need to add the fees. That’s 2’156’250 $ plus fees every hour. That’s 51’750’000$ + fees every day spent to pay for the miners. Let’s call this value E.

E=51’750’000 + fees.

How much money are miners willing to pay for electricity to gain those bitcoins right now? We do not know how many miners are there. But we know that to be in profit all the miners together must spend less than E. And what happens when they spend more than E? They are unable to turn a profit, they must sell their equipment, close the shop, and do something else. What happens if they spend much less than E? That new miners will appear or existing miners will buy more equipment and use more energy. In other words the miners, all together, will always tend toward spending a tiny bit less than they earn. We can approximate that to E and say that miners will tend to spend E for their mining operations.

How much energy does E buys you? Well, that depends on where you are in the World. But generally speaking miners will tend to concentrate where the energy is cheaper. While finding how much will Miners be willing to pay for electricity is pretty straightforward, calculating how much energy this gives you is less easy. For now this is irrelevant. We will come back to this later. We know Miners are willing to pay E for their work. How does E changes with time?

Predicting Bitcoin’s Future Energy Use

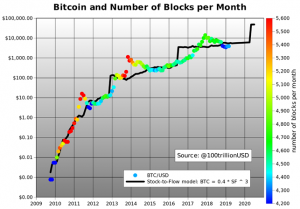

The model, Stock to Flow, when it was first presented on the 22nd of March 2019. The black line is the behaviour predicted. The dots represent the actual historical price.

Right now the most promising model of Bitcoin Price is called Stock to Flow. It has been presented by a Dutch anonymous pension fund investor which goes by the name PlanB. You can find all about him in his page. The model shows the value of Bitcoin growing in steps. Every 4 years (actually every 210’000 blocks) the miners will start producing half of the bitcoins in the previous 4 year cycle. In the first 4 years (from 2009–2012) they produced 50 bitcoins every block. In the next cycle (from 2013–2016) they produced 25 bitcoins every block. Then 12.5 (between 2017–2020) and now 6.25 (between 2021–2024). Between 2025 and 2028 they will produce 3.125 bitcoin every 10 minutes and so on. But the stock to flow predicts that the price of bitcoin will be a function of the ratio between the bitcoin mined so far and the new bitcoins created. So every time the bitcoin production halves the prices goes through a shock. Rises, enters into a bull run, reaches a bubble, decreases and finds a balance. We saw this happen in 2013, again in 2017 and again now in 2021. A higher balance than in the previous period.

And this is the behaviour observed:

The behaviour of the bitcoin price followed very precisely the values predicted by the stock to flow model. The light blue line represents an averaged value (over 463 days) which was found to better predict the behaviour.

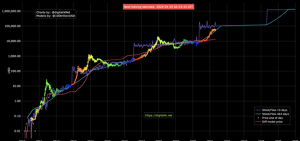

This second chart is from another analyst, “digitalik”, which recreated the model of Plan B, and updates it every day on his or her page.

The model is not exactly the same, as it was optimised in those 2 years. But mostly we can see how the behaviour tracked the model extremely well.

So in the rest of the article let us assume that in the foreseeable future Bitcoin will follow the stock to flow model. If this is true, then not only can we calculate how much miners will spend in mining operation now, but also in the future. And this should probably scare us. Because the Stock to Flow model predicts that Bitcoin price will rise by ~10 times every 4 years. But also every 4 years it will mine half the bitcoins. Thus the mining operations should cost 5 times more every 4 years, and use 5 times more energy on average. In fact because of the fees this is an optimistic evaluation as fees collected do not drop by half every 4 years, but tend instead to grow with time.

So Bitcoin uses a lot of energy and this will only get worse as time goes by. I fully support that a nation might want to discourage using electricity from the grid to mine. But not all energy is from the grid.

Types of Energy

So far we have simply referred to electricity and energy as if it was all the same. But this is not so. Transporting energy is costly. Energy gets dispersed as it gets transported. If 1 KW gets sent, less than 1 KW will be received, sometimes considerable less. This is why we haven’t seen huge solar farms in the Sahara selling energy to Europe, for example. This is why oil gets sent around the World, instead of burning it where it is extracted, while sending the produced energy. Storing energy. Sending stored energy has always been the bottleneck in the energetic business.

This is so important that there are some countries, like Iceland, that has an excess of energy and uses this extra energy to produce something that is energy intensive. And then sell it.

An aluminum smelter in Iceland. Source

Iceland is the 11th biggest exporter in aluminium in the World. Yes, you read that correctly. That tiny nation rivals huge nations. Because Iceland has so much energy and cannot export that energy, instead exports aluminium. Why it cannot export the energy? The energy production in Iceland is 99.9% renewables and pretty much all of it from geothermal (volcanoes) and hydroelectric (dams). Not something exportable. While exporting the energy in electrical format is unfeasible because of dispersion as said above. What happens to the cost of energy in a place where there is an excess of energy? It drops.

So we have learned that there are some energy sources that cannot be transported, that are present in a particular place. And those places end up having an excess of cheap energy.

Then there are places that are power hungry. Those places need energy. The source for this energy either gets transported to them, or close enough to them. Then energy is produced and transported for the last (thousand) mile(s) toward where it is needed. They will also use any local energy. Which energy do they usually use? Mostly non renewable energy. Coal can be transported and it is non renewable. Oil can be transported and it is non renewable. The result is that the energy in those places will tend to cost more.

It should be noted that in some places around the World there are electrical contracts that permit you to pay a fixed fee for an “all you can get” amount of energy. This kind of contract is extremely dangerous in a context where users might use electricity to mine bitcoin and should be illegal.

Shouldn’t all mining with electricity from the grid (where it compete with everyday uses of electricity) be made illegal? Not necessarily. The side effect of mining is heat. Many countries use heat from electricity to heat up rooms or cooking in the kitchen. In some countries it is even illegal to use gas stoves for security reasons. In those places it would be extremely beneficial to have the heating system be actually a mining system that can be turned on and off at will. Provided the cost of electricity is high enough, this will simply lower the cost of heating without making people turn on the heating just to mine.

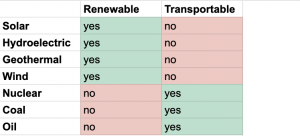

renewable sources cannot be transported, non renewable can be transported

We discovered that Iceland cannot sell its energetic sources. This is a general trend: renewable sources of energy cannot be transported, non renewable sources of energy can be transported.

So we will expect places with an excess of energy to all be rich on renewable energy.

Why all this is important? Because Bitcoin miners have a fixed budget defined globally to fund their mining operations. And as such will tend to gravitate toward cheaper forms of energy. Toward the cheapest available, in fact. Thus we would expect they will tend toward places with an abundance of energy. Being unable to fund their operations anywhere else.

A notable exception is Venezuela. Energy in Venezuela is very cheap. But this is because of US sanctions that are making it impossible for Venezuelan companies to sell their oil. In other words the Venezuelan energy excess was induced by political reasons. And Venezuela is reacting to this by transforming the energy into Bitcoin and selling those Bitcoins in the market.

Another interesting case is Nuclear power.

Image of a Nuclear Power Plant from Wikipedia

Nuclear Power Plants cannot be easily turned on or off. It takes many days to stop a nuclear power plant. And not always it is easy to store the excess of energy produced by a plant in a moment when it is not needed. Historically one of the ways to store this excess of energy was through Hydroelectric powers plants. Hydroelectric power plants can work normally extracting energy from water descent. But can also work in reverse, pumping water back up. And then the lake becomes a huge electrical battery. So a nuclear power plant and a hydroelectric plant would work in tandem. During the day they would both produce energy. At night the nuclear power plant would keep producing energy which would get stored through the hydroelectric one.

This is again a place where energy is in excess, and where mining would be profitable. But of course the cheap energy might never hit the grid. The only way for it to be used for mining is if the company running the Nuclear Power Plant uses it for mining. So was Nuclear energy ever used for Mining? Apparently so, but since it was not done legally the computers were seized by the authorities.

Final example, the big dams in China. China has been building ghost cities for many decades now. According to some those represents the most useless products of a corrupt and centralised government trying to keep its population busy and the GDP from falling. Others contend that those cities are in key areas that will become optimal once global warming hits with its full force. And they represent the best visionary product of a government mostly made up of engineers. Opinions differ. In either cases those cities are planned to use the electricity from huge hydroelectric power plants. Power plants which are already available, but under utilised. In several cases bitcoin mining represented a use of this energy in the meantime.

We should note that while the market tends to find a solution for those excess of energy either in the form of selling energy intense products or storing it in lake, it comes at huge cost. Sending aluminium around the World is costly. And there is considerable energetic dispersion in sending water up a hill. Mining represents a good alternative solution.

Conclusions

So the general trend is: Bitcoin mining uses much energy; the energy needed for Bitcoin mining will grow in future; Bitcoin will tend to use the cheapest energy available on the planet; there are places in the planet where there is an excess of energy; this energy cannot be transported; this energy will generally be produced by renewable energy because non renewable energy sources can be transported (unless blocked by sanctions); so bitcoin mining will use excess energy from around the globe, which will be from renewable which cannot be used otherwise.

image stolen from somewhere on the the internet

It is easy to think that energy is something precious, and that we should conserve it. This is simple reasoning, what mathematicians call “first approximation”. And on first approximation it is true. But a deeper analysis shows that energy cannot be transported, and in some places energy is precious while in other it is in excess. Bitcoin Mining will always use the cheaper energy on the planted which will inevitably be from places where there is an excess of energy.

Takeaway for Policymakers

It is true that bitcoin uses a lot of energy. But it is also true that the energy used by Bitcoin is generally the cheapest less needed form of energy. This has some consequences:

- Contracts that permit “all you can get” amount of energy for a fixed price should be illegal.

- Policymakers that govern areas with an excess of energy should consider allowing the use of the extra energy for mining operations. In a win win scenario it might actually represent a good taxation stream.

- Sanctions that stops countries from selling oil are now useless, if not counterproductive, and should be avoided.

Article ended on the 2nd of May 2021. Bitcoin Price right now 56’500$.