ISTITUTO UNIVERSITARIO SOPHIA

LAUREA MAGISTRALE IN SCIENZE ECONOMICHE E POLITICHE

POSTGRADUATE MASTER’S DEGREE IN ECONOMIC AND POLITICAL SCIENCES

PROGRAMME IN ECONOMICS AND MANAGEMENT

SPECIALIZATION IN HUMANISTIC MANAGEMENT

TRUSTING A TRUSTLESS NETWORK

The Paradoxes of Trust in Blockchain Technology

JENA MARIE ESPELITA N°18LOEF0489

Supervisor:

Prof. ANNETTE PELKMANS-BALAOING

Co-supervisors:

Prof. IVAN VITALI

Prof. BENEDETTO GUI

ANNO ACCADEMICO 2019-2020

TABLE OF CONTENTS

ACKNOWLEDGEMENTS 6

INTRODUCTION 7

TRUST 10

1. Defining trust 10

1.1. Types of trust 11

1.2. Vulnerability and trustworthiness 13

2. The rise of distributed trust 14

2.1. How trust is broken 15

2.2. A crisis of trust 15

2.3. The trust shift 16

3. The Trust Stack 17

3.1. Trusting the idea 18

3.2. Trusting the platform 19

3.3. Trusting the other person 19

4. Trust Architectures 21

4.1. Peer-to-peer trust 21

4.2. Leviathan 22

4.3. Intermediary 22

5. “Trustless” Trust Architecture 23

BLOCKCHAIN 25

1. Defining a blockchain 25

1.1. Immutability 26

1.2. Distributed Ledger 28

1.3. Consensus 31

1.4. Tokenization 34

1.5. Smart Contracts 35

2. The Blockchain Trilemma: Decentralized, Scalable and Secure 38

2.1. Decentralization 38

2.2. Security 39

2.3. Scalability 39

3. Blockchain Ecosystems Landscape 41

TRUST AND BLOCKCHAIN 43

1. The paradoxes of trust in blockchain technology 43

1.1. Decentralized yet centralized 44

1.2. Immutable yet changeable 49

1.3. Transparent yet highly encrypted 53

1.4. Algorithmic yet human 58

1.5. Other considerations 61

2. Blockchain for Social Impact 62

2.1. Health 62

2.2. Agriculture 64

2.3. Land Rights 65

2.4. Energy 66

2.5. Digital Identity 67

2.6. Financial Inclusion 68

2.7. Governance and Democracy 69

SUMMARY, RECOMMENDATIONS AND CONCLUSIONS 71

BIBLIOGRAPHY 78

TABLE OF FIGURES

FIGURE 1. DEPICTION OF TRUST 13

FIGURE 2. TRUST LEAPS 17

FIGURE 3. SYMBOLIC REPRESENTATIONS OF THE THREE ESTABLISHED TRUST ARCHITECTURES. 21

FIGURE 4. THE BLOCKCHAIN’S “TRUSTLESS” TRUST ARCHITECTURE 24

FIGURE 5. THE ARCHITECTURE OF MERKLE TREE IN THE BLOCKCHAIN 26

FIGURE 6. (A) CENTRALIZED. (B) DECENTRALIZED. (C) DISTRIBUTED NETWORKS 29

FIGURE 7. HOW A BLOCKCHAIN WORKS 35

FIGURE 8. HOW BLOCKCHAIN CRYPTOGRAPHY WORKS 36

FIGURE 9. THE BLOCKCHAIN TRILEMMA 40

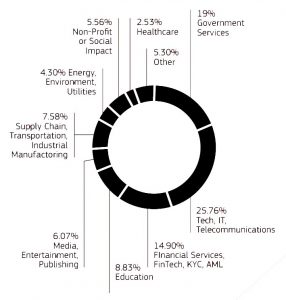

FIGURE 10. CURRENT SECTORS USING BLOCKCHAIN IN EUROPE 41

FIGURE 11. REPRESENTATION OF A HARD FORK 52

ACKNOWLEDGEMENTS

This work is the culmination of all my adventures in these last two years, which are ironically unrelated to academics, but are of friendship, self-love, and perseverance even in the midst of a world that literally seemed to be falling apart – 2020, you are a wonder.

And with a heart full of gratitude, I would like to say “thank you” to:

My dad, who was the first one to read anything I’ve ever written, and has been the hardest and best critic. To my mom, who has supported me throughout everything: you and dad have been pliant bows to this living arrow. To my weird sisters: I have never come across such odd rocks; I hope you know how much you mean to me. To my on-call brother, who always picks up my calls at the strangest hours: here’s to adulting, eh? To my big brother, who I will always look up to: looky! I made a thingy! You all are the reason I’m still here, in every sense.

To my companions throughout these years in Sophia: non sarei soppravvissuta senza di voi, sarete sempre le mie sorelle. To Loppiano, the Filipino community, and all those who have given me light even through the briefest of encounters: each of you will forever be etched on my soul. To Sophia, and the exemplary professors who have given us so much more than just lessons in the classroom: you have inspired me and influenced me deeply as a person, and as a citizen of the world. To my supervisor and co-supervisors, thank you for the guidance and the freedom you have allowed me, with which I was able to write a thesis that I can be proud of. And finally, to my stripy friend and constant pep talker: it was a crazy ride, wasn’t it?

Thank you all, for every piece that each of you has added into this strange masterpiece that I’ve found myself in. To God be the glory.

INTRODUCTION

The Edelman Trust Barometer is a global survey that measures the people’s trust in relationship with the four core institutions – companies or brands, governments, NGOs and media. For the year 2018, it revealed that trust has changed profoundly, and noted that although there is a divergence of trust in other aspects, the world is united on one front – all share an urgent desire for change. Only one in five feels that the system is working for them, with nearly half of the mass population believing that the system is failing them (Edelman, 2019). Studies attribute this loss of trust to the Global Financial Crisis of 2008, as its aftermath exposed systemic flaws that brought the world economic order to the brink of collapse (Edelman, 2017; Nandwani, 2019). The study further reveals that for the year 2019, despite it being in an era of strong global economy and near full employment within the surveyed countries, none of the four societal institutions that the study measures are trusted (Edelman, 2020).

Concurrently, technology continues to alter human behaviors and instincts, pushing institutions to keep up with changing customer expectations while simultaneously developing the technologies of the future (Marshall, 2018). According to Rachel Botsman (2017), these changes are indicative of a new phase in the evolution of trust. The dwindling of trust in institutional power is accompanied by an emergence of a new kind of trust that moves power away from a single source and shares that responsibility across a wide range of sources.

With the Global Financial Crisis as foreground, a white paper introducing Bitcoin was published in 2008 by a person (or a group) called Satoshi Nakamoto. It described the concept of a cryptocurrency implemented on top of a blockchain, which could provide an alternative way to build trust, record truth, secure transactions and create a decentralized network spanning the globe outside the purview of any authority (Nandwani, 2019). Riding the wave of distributed trust, the blockchain has been cause for much excitement since its very nature allows the empowering of communities over central authorities.

The potential impact of the underlying technology, much more than that of the cryptocurrency, is often compared to the impact of the Internet, which now pervades our everyday life (Arun et al., 2019), and is considered a potential disruptive technology, i.e., an innovation that significantly alters the way that consumers, industries, or businesses operate because of the way it “generates” trust where there is none (Werbach, 2018).

The scope of this study derives from the literature gap in the definition of “blockchain trust”. Andreas Anotonopoulos (2015), author of Mastering Bitcoin, calls the blockchain “trust-by-computation”, while Reid Hoffman (2015), venture capitalist and LinkedIn founder, labels it “trustless trust”. Academic Kevin Werbach (2018) contends that it is a new kind of trust altogether, while security technologist Bruce Schneier (2019) argues that there is no good reason to trust blockchain at all. The question, therefore, that the research poses is this: “How can ‘blockchain trust’ be defined, and can blockchain be trusted?”.

This research is an exploratory one, given that blockchain is a relatively new technology and that most case studies are still in their infancy, save the earlier blockchains such as Bitcoin and Ethereum. The study employs a secondary research method, consisting largely of online and literature research. Case study research on the 2016 DAO hack has also proved useful in determining the limitations and areas for improvement of the technology. Primarily, the objective of the study is to examine the hypothesis that blockchain is indeed a technology that can pervade the world of finance, economics and other sectors as a new architecture of trust.

To understand the correlation between trust and blockchain, a deconstruction of some of our existing social and philosophical constructs is required, such as how we trust each other and how we arrive at the truth and then record it (Nandwani, 2019). Thusly, the first chapter discusses the general definition of trust, how trust is built, how trust is broken, the rise of distributed trust, and the various architectures of trust that have developed over history. Theoretically, this chapter aims to describe the societal foundations on which the blockchain is set.

In chapter 2, a technical overview of blockchain is presented, along with an outline of the so-called “Blockchain Trilemma”. This section discusses the core concepts of blockchain, such as hashing, consensus algorithms, distributed ledger technology, and smart contracts. The Blockchain Trilemma, on the other hand, describes the ongoing attempt of developers to solve the equilibrium between decentralization, security and scalability. The chapter is capped off with a brief overview of the blockchain ecosystem and the technology’s diffusion on a global scale.

Chapter 3 presents the findings about blockchain trust, structured into four paradoxes: decentralized yet centralized, immutable yet changeable, transparent yet highly encrypted, algorithmic yet human. It aims to adequately describe the various benefits, implications and limitations of each element that are inherent in a blockchain – the very features that make blockchain unique. The chapter then ends with some notable applications of blockchain in the social sector, demonstrating the possibilities that blockchain has in store for us.

Chapter 1

TRUST

Trust is an elusive concept. Despite its pervasiveness in the decisions we make on a daily basis, its definition has been a subject of discussion among philosophers for centuries. As Larue Tone Hosmer (1995) states, “There appears to be widespread agreement on the importance of trust in human conduct, but […] an equally widespread lack of agreement on a suitable definition of the construct.”

Without trust, we would need to verify and secure the reliability of everyone we encountered, which is practically impossible. Trust is fundamental to almost every action, relationship and transaction (Werbach, 2018). Communities would definitely not exist without it, and so it makes human society itself possible (Luhman, 1979). It enables small and large acts of cooperation that all add up to increased economic efficiency (Botsman, 2017). Virtually every commercial transaction has within itself an element of trust, certainly any transaction conducted over a period of time (Arrow, 1972). In this sense, it is the oil that lubricates social and business transactions, and the factor that renders the boundless complexity of the modern world tractable (Werbach, 2018).

1. Defining trust

How do we define trust? Trust is not binary – one need not be categorized as either perfectly trusting or purely untrusting (Cross, 2005). Putnam (2000) distinguishes “thick” trust, arising from close-knit social relationships, from “thin” trust, among a society in general. Fukuyama (1996) differentiates high-trust and low-trust societies. Fernando Flores and Robert Solomon (2001) differentiate “naïve” trust, based on pure faith, from “authentic” trust, grounded in relationships. Botsman (2017) distinguishes “local” trust from “institutional” trust, and later on “distributed” trust. For many, trust is about confidently relying on another person. The more we interact with a person over time, the more confident we become about how they will behave. This kind of trust is known as “personalized” trust, while “generalized” trust is the trust we attach to an identifiable but unidentified group or thing (Sapienza and Zingales, 2011). Trust can therefore be viewed on a spectrum along multiple dimensions.

1.1. Types of trust

Among the various taxonomies of trust, it can be broken down into two basic theoretical types: cognitive trust and affective trust. Although these two concepts are not perfectly discrete, they can serve as tools in analyzing and understanding the concept of trust.

1.1.1. Cognitive trust

A simplistic definition of trust is cognitive risk assessment: is it reasonable to rely on this person or organization? In its strictest form, it is based upon a cost-benefit analysis of the benefits of trust versus the associated risks (Cross, 2005). Economist Oliver Williamson (1993) describes this as “calculativeness” because it is subject to rational calculation. In a business context, it is necessary for any large entity to trust upon agents to perform transactions in order for the entity to gain the benefit of new business. On a more personal level, a mother gains free time from trusting a babysitter to watch her child. There is, of course, a running risk in both cases. An agent in the company might usurp a business opportunity, while the babysitter could harm the mother’s child. Cognitive trust requires an assessment of the probability and the magnitude of that risk of harm (Cross, 2005).

The cognitive assessment of trust is also affected by the facility and effectiveness of monitoring the party to be trusted. With the possibility of monitoring, one can find out if one’s trust is misplaced and thus withdraw from trusting. In assessing the relative risk of trusting, the ex-ante risks are often part of the equation as well, such as the reputation or past experiences or recommendations. Post facto remedies are also incorporated in the assessment of this risk. For example, laws against embezzlement provides a form of hedging against the risk that a company’s trust was misplaced (Luhman, 1979). Another example can be found in e-marketing, wherein the customer is asked to give the number of his credit card to the marketer on a platform such as Amazon or other online retailers. While it would seem unlikely that such private information should be entrusted to a stranger, people do indeed give up their credit card numbers because of legal protections against credit card fraud, plus the effects and potential legal penalties on the marketer’s firm should discourage misuse of the number. Taking everything into account, a cognitive assessment of the user would arrive at the conclusion that the credit card number would not likely be abused (Cross, 2005).

1.1.2. Affective trust

While the cognitive dimension is important, it cannot represent the entirety of trust. Otherwise, trust would be nothing more than rational reliance. Affective trust, on the other hand, is considered to be “true” or “real” or “moralistic”, and has no obvious strategic component (Rose, 1995). It is the optimistic disposition toward others that operates outside strategic motivation – an expectation of goodwill on the part of an agent (Baier, 1986). In this category, “to trust someone is to have an attitude of optimism about her goodwill and to have the confident expectation that, when the need arises, the one trusted will be directly and favorably moved by the thought that you are counting on her”. In affective trust, “we impute honorable motives to those we trust” and “typically do not even stop to consider the harms they might cause if they have dishonorable motives” (Jones, 1996). In a business context, we can think of the bank that gives a failing but sympathetic borrower another chance, rather than foreclosing when it has the right to do so.

Moreover, there are moral aspects to affective trust (Wicks et al., 1999). Trust is an expression of our goodness, not simply of our self-interest. Fukuyama (1996) describes trust as “a set of ethical habits and reciprocal moral obligations internalized by members of a community.” Such moral trust is a statement about how people should behave and how “they ought to trust each other” (Cross, 2005). If so, trust is commanded as a general rule, and is not a strategic calculation. Trust, therefore is a more complex psychological state that incorporates social and emotional factors, and is concerned with motives, not just actions or interests (Blair et al., 2018).

1.1.3. Combining cognitive and affective trust

Although there is a practical distinction between affective and cognitive trust, affective trust may itself be fundamentally cognitive and strategic if our nature is hardwired by evolution into our brains or is the product of experience (Cross, 2005). Cognitive trust, while retaining its conscious assessment of risk, likewise contains an affective component. The most cognitive analysis of trust must still require some affective optimism about the party to be trusted. As a matter of human nature, behavior is rarely either entirely instrumental or purely emotion. Optimal trust, hence, is the combination of affective and cognitive trust (Wicks et al., 1999).

1.2. Vulnerability and trustworthiness

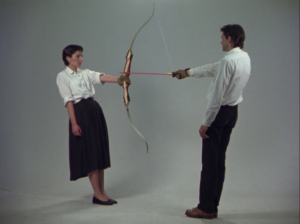

Trust, as we all know, is not an ironclad guarantee of performance, since trust can be exploited by the untrustworthy. As portrayed in Figure 1, trust is shown alongside the presence of danger. Do I trust in his strength or capacity to hold on to the arrow? Does he have any hidden intentions of hurting me? A gap exists, a grey area where something unknown could happen. A gap constantly exists in every transaction – in the encrypted algorithms upon entering your credit card details to buy something online; the first time you eat at a restaurant; or in our mere getting on a plane or train. To trust is to be vulnerable to the one trusted (Rousseau et al., 1998).

Figure 1. Depiction of Trust

(Marina Abramović and ULAY, 1980)

Vulnerability entails an interdependence between the actors in a relationship of trust, and calls to attention a second aspect: trustworthiness. According to Onora O’Neill (2002), the four traits of trustworthiness are the following: competency, reliability, integrity, and benevolence. Furthermore, Vittorio Pelligra (2013) cites various explanations in terms of game theory as to why a rational agent may decide to be trustworthy. The Folk Theorem suggests that in the long run, or more precisely in an infinitely repeated “trust game”, it shows that trusting and being trustworthy are the most rational courses of action. This is due to the fact that the choice of being or not being trustworthy could have repercussions on the future interactions with the partner. Other theories, such as enlightened self-interest, altruism, inequality-aversion, reciprocity, guilt-aversion, collective rationality and trust responsiveness are also cited, considering both exogenous and endogenous elements of influence on one’s choices. Social approval, reputation, as well as the player’s self-esteem, are all drivers of trustworthiness. In this regard, trust and trustworthiness can be considered as relational concepts, emerging and developing within a trust relationship (Pelligra, 2013).

Roger Mayer (1995) and his coauthors write: “Trust is the willingness of a party to be vulnerable to the actions of another party based on the expectation that the other will perform a particular action important to the trustor, irrespective of the ability to monitor or control that other part.” Trust, therefore, is a two-sided coin. On one side is a belief rooted in some combination of rational and emotional factors; on the other is acceptance of uncontrolled risk (Hurwitz, 2013). It is exactly this vulnerability alongside trust, however, that Satoshi Nakamoto, creator of blockchain technology, hopes to eliminate by proposing “a system of electronic transactions without relying on trust” (Nakamoto, 2009). The costs incurred along with the need for trust in intermediaries or third-parties are thus eliminated through a system based on cryptographic proof. This gave Reid Hoffman (2015) reason to label blockchain trust as “trustless trust”. The questions that come to mind are: How can this kind of trust be defined? Or, does blockchain truly eliminate the need for trust?

2. The rise of distributed trust

In 2017, The Edelman Trust Barometer released a report entitled An Implosion of Trust and reveals that trust is in crisis around the world (Edelman, 2017). It finds that two-thirds of the surveyed countries are now “distrusters”, i.e., less than half of the population trust the mainstream institutions of business, government, media and NGOs to do what is right. Around the world, high-trust societies outperform low-trust ones (Fukuyama, 1996). Business scholars similarly find empirically that companies where trust is high perform better (Davis et al., 1995). Societal trust has the capacity to shape interactions, potentially in very significant ways. It shapes both the macrostructures of national economic performance and the microstructures of individual and firm interactions (Werbach, 2018). Those who are trusted are powerful, and systems that alter the scope of trust are therefore capable of changing societies. What then is causing the fraying of societal trust today?

2.1. How trust is broken

Trust can fail in three ways: direct violations, opportunistic behavior, and systemic collapse (Werbach, 2018). Violations of trust are the clearest examples – a restaurant that serves you substandard food; a friend who borrows money without any intention of paying you back; a politician stealing state funds – each takes advantage of the trustor’s vulnerability to cause harm.

Trust is especially difficult to restore when the untrustworthy behavior involves deception, which is the foundation for the second category of trust breakdown: opportunism (Werbach, 2018). «Opportunism means violating the spirit, but not necessarily the letter, of an agreement by taking advantage of asymmetric information» (Muris, 1981). Gaming the reputational system, i.e., using fake accounts to post high-rated reviews on their own products, breaks the whole idea of trustworthiness within e-commerce.

Finally, trust sometimes fails not because the parties to an arrangement are necessarily untrustworthy, but because the environment is inimical to trust. Despite the capacity, competency and willingness of the actors to be trustworthy, there is a systemic failure that makes it unwise for anyone to trust (Werbach, 2018). An example would be how an unfair administration of the criminal justice system undermines trust, and therefore law-abidingness (Tyler, 2001).

2.2. A crisis of trust

The profound crisis cited in the Edelman Trust Barometer Report has its origins in the Great Recession of 2008, and is the culmination of events and patterns that have been developing for many years (Edelman, 2017). The systemic breakdown of trust comes down to an application of different rules for different folks. It is another type of inequality that is rising – that of the fundamental inequality of accountability (Hayes, 2013). Furthermore, Hayes states that we cannot have a just society that applies the principles of accountability to the powerless and the principle of forgiveness to the powerful. Yet, in the past decades, there have been blatant displays of this inequality. Just one of the many reasons why institutional trust is eroding on a global scale is the release of the Panama Papers that revealed proof of tax evasion by billionaire business moguls and superstar athletes alike (Edelman, 2017).

2.3. The trust shift

A trust shift is happening. According to the Edelman Trust Barometer of 2016, a friend or an acquaintance on Facebook is viewed as twice more credible than a government leader. The mass population is relying less on newspapers and magazines and more on self-affirming online communities (Edelman, 2016). As institutional trust collapses, a space for new systems of trust emerges. Technology is enabling trust across huge networks of people, organizations and intelligent machines in ways that are unbundling traditional trust hierarchies. The stories of multi-billion-dollar companies such as Airbnb and Uber, whose success depends on trust between strangers, independent of one’s credentials or affiliation with a trusted institution, is characteristic of this novelty. This is the rise of distributed trust (Botsman, 2017).

We are at the start of the third, biggest trust revolution in the history of humankind. A trust shift does not mean that the previous forms will completely be superseded, only that the new form will become more dominant. The first phase was local trust, where it was based on one-to-one interactions and personal reputation. Next came institutional trust – to cope with mass urbanization and international trade, institutions and institutional mechanisms were invented, from brands and the idea of middlemen to things like insurance and contracts. Distributed trust, on the other hand, takes the power away from a single source and shares the responsibility across a wide range of sources (Botsman, 2017).

While still in its beginnings, certain characteristics are already apparent. Trust that used to flow upwards to authorities and experts is now flowing horizontally, in some instances to our fellow human beings and, in other cases, to programs and bots. Distributed trust helps us understand why digital cryptocurrencies such as bitcoin could potentially be the future of money, and why the blockchain is being invested in for everything – from provenance tracking of food and blood diamonds, to independently copyrighting digital and intellectual assets, to selling our homes without the need for estate agents. The real disruption that is happening is not technology itself, but the massive trust shift it creates (Botsman, 2017).

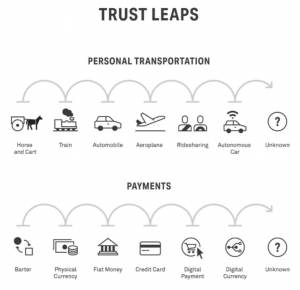

3. The Trust Stack

To understand how we can even begin to trust blockchain technology, a breakdown of the process of building trust in a new technology is studied. A lot of the things we normally do in the digital space now were not always automatically trusted. For example, the use of peer-to-peer technology systems to transfer money instead of using a bank, post office or brands such as Western Union, is a method that is quickly getting traction. A trust leap, or that which occurs when we take a risk and do something new or in a fundamentally different way, is needed (Botsman, 2017). The era we live in requires us to take trust leaps at a surprisingly high rate – we have jumped from using credit cards to dabbling with cryptocurrencies; from making reservations at trusted hotel brands to booking rooms from complete strangers; from public transportation to using Uber or Blablacar; from libraries and encyclopedias, to open information-sharing hubs such as Stack Overflow and Wikipedia; and just recently, we’ve started to take a giant trust leap on self-driving cars and Artificial Intelligence.

Figure 2. Trust Leaps (Botsman, 2017)

Figure 2. Trust Leaps (Botsman, 2017)

For a trust leap to occur towards new or disruptive technologies, certain conditions need to be fulfilled, just as deciding to trust another person calls for certain prerequisites. Amid the fascinating nuances in how trust works, there is an observed common behavioral pattern that people follow in forming trust in new technologies and businesses. This pattern is described in the Trust Stack model and comprises the following: trust in the idea, trust in the company or platform, and trust in the other person (in other instances a machine or robot) (Botsman, 2017).

3.1. Trusting the idea

On the first level, we have to trust that the idea is safe and worth trying. There has to be enough understanding and certainty, or reduced uncertainty, to make us willing to try the idea. To fill the gap of uncertainty, we need to grasp what it can do and what it can give us. Until that chasm is crossed, we will not abandon what we already have (Moore, 2006).

Take the idea of self-driving cars for example. Initially, the idea of being driven by an invisible driver was met with much hesitation . On the other hand, it was predicted that by 2040, autonomous vehicles will account up to 75% of vehicles on the road (Newcomb, 2012). Also, statistics dictate that human error and inconsistent driving cause more than 90% of crashes, ergo, driverless cars could reduce traffic fatalities by up to 90% (GRGB Law, 2016). Lastly, a typical American commuter spends on average more than fifty-two minutes per day in traffic, which adds to more than 4 billion hours of wasted time a year in the United States alone – time that could have been used in better ways (Thrun, 2017).

For first-time passengers of an autonomous car, the ride is met with awe and amazement, and sometimes even fear. However, Dr. Brian Lathrop, expert in cognitive psychology and human interface design, recounts in an interview that after an average of 20 minutes, a shift happens – the experience begins to feel normal, even boring. As it turns out, being driven by an intelligent machine is just not that exciting. This is because we are, in fact, very much used to being in the passenger seat with someone else driving (Lathrop, 2016). The trust leap, in this case, is not of taking on a new experience, but that of trusting a machine versus a human to drive. Once that happens, trust occurs almost too easily – to the point of being comfortable enough to nod off in an autonomous car. The point of global adoption of self-driving cars does not depend on engineering success, nor on the users’ understanding of the technology. It depends on the principle of getting people to trust an idea (Botsman, 2017).

3.2. Trusting the platform

The next stage is about knowing whether or not our trust is intelligently placed in the hands of an unfamiliar entity. Do I trust in the brand? Or in the case of digital platforms: do I have confidence in the platform itself, the app, payments, rating system, or in the algorithm? In the late 1800’s, branding used to be the primary way of deciding on this stage of the trust stack. As cities expanded and goods became mass-produced, person-to-person trust was no longer viable (Botsman, 2017). Since then, a whole field of psychology for marketing has developed – one that taps into consumer’s emotions as a way of gaining one’s trust and influencing one’s purchasing decisions (Gillette, 2015).

With the onset of social media in the 21st century, the person formerly known as a “passive consumer” suddenly participates as a social ambassador through photo posts and “likes”. A shift in the companies’ interest took place as they then prioritized delivering authentic experiences, as opposed to exaggerated or false claims, and focusing on customer support and interfacing in real time. Now, customers have become communities, and the communities have themselves become the platforms that shape the ups and downs of a brand (Botsman, 2017). In a recent survey by Nielsen (2015), it was revealed that the most credible advertising comes straight from the people we know and trust.

3.3. Trusting the other person

The third and final stage is the use of the different bits of information to decide whether the other person (or machine) is trustworthy or not. Personal encounters and social cues assist in evaluating these traits, but what happens on the digital platform, where all we have to go on is the pseudo-identity of a vendor? Today, we can make decisions on trust based on collective experience – the experiences other people have shared through reviews and social networks. The fact that everything is rated on both sides – from houses and drivers vs. occupants and passengers, on to products and services vs. buyers or clients, etc. – is our way of distinguishing the trustworthiness of both the vendor and the consumer (Botsman, 2017).

Technology, however, is creating trust between the unlikeliest of characters, even in the nefarious world of the “Darknet” – an encrypted network of secret websites that allows the exchange of illegal assets such as drugs, stolen financial data, and firearms (Reiff, 2020). The great oxymoron is that it is populated by hundreds of thousands of vendors who would commonly be stereotyped as untrustworthy, yet here they are creating highly efficient markets (Botsman, 2017). As it turns out, user ratings create a social pressure or economic incentive that can make even drug dealers care about their online brand and customer satisfaction.

Reputation is trust’s closest sibling, and is an essential asset, yet it is not the only thing that fuels trust. Benevolence comes down to empathy and goodwill, but where does that fit in with regards to the Darknet? Political scientist Russel Hardin (2002) argues that trust is really about encapsulated interest, i.e., a kind of closed loop of each party’s self-interests. Like the real estate agent who sells a house at a reasonable price not because she cares about the client but because her commission is directly tied to the sale price, the drug dealer also earns more by being honest rather than by colluding.

Sections 1, 2 and 3 cite various ways by which trust is defined, broken and built, but it should be acknowledged that there is a vast area of studies elsewhere, in the socio-philosophical field and in the field of economics and game theory, that expounds on the definition and the processes within trust.

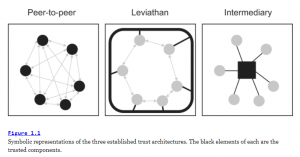

4. Trust Architectures

To understand further the predisposition of people to trust in different ways, the main institutional structures for manifesting trust are presented. Additionally, this distinction collocates the emergence of blockchain on the trust map, i.e., where blockchain fits into this whole story of trust. Just as the physical architecture of neighborhoods determines the character of communities, or the digital architecture of communications networks shapes opportunities for innovation, creativity, and free expression online, the architectures of trust embody the multiple ways trust is formed. The following are the three main architectures are Peer-to-peer, Leviathan and Intermediary (Werbach, 2018).

Figure 3. Symbolic representations of the three established trust architectures.

Figure 3. Symbolic representations of the three established trust architectures.

The black elements of each are the trusted components (Werbach, 2018).

4.1. Peer-to-peer trust

P2P trust is based on relationships and shared ethical norms, and is the earliest human trust structure to develop, often manifesting in the interpersonal trust among families and clans. This trust falls under “local” trust, or trust that rests in someone specific, particularly in one we are familiar with. P2P trust architectures are prevalent even to this day, and exhibit three main characteristics: they are in communities with shared social norms; they have effective governance mechanisms among themselves; and there is an adherence to a set of principles for self-governance, coupled with the flexibility of individuals and communities to adjust in order to solve problems (Ostrom, 1990).

Since it rests on mutual commitments and personal relationships, it can be considered as a “thick” kind of trust, rather than a “thin” trust that relies on momentary convenience (Putnam, 2000). Traditional P2P trust, however, has a relatively small radius. Trust in a member of the same community might not go beyond unimportant transactions where the stakes are relatively low. For this, the design requires clear group boundaries and the opportunity for those affected by the rules to participate in modifying them (Werbach, 2018).

In this digital age, a new kind of P2P trust has emerged. The same structure can be seen in systems such as Wikipedia, open-source software communities, and user-moderated content sites such as Reddit. These models expand the scope of peer-to-peer trust into a form of distributed trust, while maintaining its dependence on a combination of formal rules and communal standards that are rarely present in complex impersonal marketplaces (Frischmann, 2013).

4.2. Leviathan

Based on the vision of seventeenth-century philosopher Thomas Hobbes, the Leviathan architecture grants a governing body monopoly on the legitimate use of violence. Trust is nevertheless, according to Hobbes, the foundational force in the establishment (Hobbes, 1651). With Leviathan trust, a powerful central authority not afflicted with greed or tendencies toward self-interest operates largely in the background to prevent others from imposing their will through force or trickery. Leviathan trust is therefore a strong form of institutional trust. Knowing that there are penalties for breach, the individuals and organizations that take part in the architecture feel comfortable taking the risks inherent in trusting relationships (Werbach, 2018).

Leviathan trust relies highly on bureaucratic rules for participation, as well as dispute resolution. It is essentially through law enforcement or military activities that the central authority maintains a baseline level of trust in social stability. The legal system, with its thicket of doctrine, defines constraints on arbitrary state power. Therefore, when the legal system fails, so does trust (Tyler, 2001).

4.3. Intermediary

In an Intermediary architecture, a third party intervenes to provide valuable services that induce individuals to hand over power or control, and hence falls under institutional trust as well. The local rules and the reputation of the intermediaries take the place of social norms and government-issued laws to structure transactions (North, 1990). Like commercial banks that facilitate the transaction flow between depositors and borrowers, activity is possible through the intermediaries’ ability to aggregate activity on both sides. Financial services relationships are a good example of intermediary trust – commercial banks mediate the transaction flow between depositors and borrowers, generating and paying interest along the way (Werbach, 2018).

Intermediary trust is particularly significant online (Hurwitz, 2013). Advertisers trust platforms such as Google because of its transparency in its pricing and performance metrics for their ads. On the other hand, users trust it because it returns high-quality search results surrounded by ads that are tailored and therefore relevant to the user. While Amazon and eBay are among the top trusted intermediaries for online transactions, in general, the reputational system used for even the smallest online shop can be effective in inciting trust among buyers. Although these platforms are often described as peer-to-peer, they are more appropriately considered to be intermediary, because users are actually trusting the platform, not the personal relationships or community-defined rules of governance (Werbach, 2018).

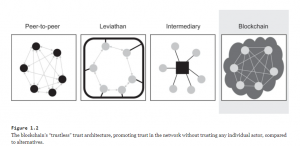

5. “Trustless” Trust Architecture

In retrospect, all three architectures defined above involve a trust trade-off wherein users give up some freedom to gain the benefits of trust. In P2P, the participants must conform to the norms of the community in order to partake in it, and in turn be trusted by other members of the community. Leviathan trust reduces the member to subservience to the state, with the knowledge that other members who are potential perpetrators are equally subservient as well. In the case of intermediary trust, members cede control over personal data, trusting the third party not to exploit its power despite the asymmetry of information (Werbach, 2018).

Figure 4. The blockchain’s “Trustless” Trust Architecture

Promoting trust in the network without trusting any individual actor, compared to alternatives (Werbach, 2018).

The blockchain creates a new kind of architecture that none of the established models encompass. On a blockchain network, nothing is assumed to be trustworthy except the output of the network itself (Werbach, 2018). On any transaction, there are three elements that may be trusted: the counterparty, the intermediary, and the dispute resolution mechanism (Botsman, 2017). Simply put, blockchain tries to replace all three elements with software code. People are represented through arbitrary digital keys, thus eliminating contextual factors that humans use to evaluate trustworthiness. The intermediary is replaced with a transaction platform that is distributed and machine-operated. Finally, the dispute resolution occurs through “smart contracts” that execute predefined algorithms (Werbach, 2018).

In doing so, blockchain trust severs the connection between institutional actors and the system. Compared to its alternatives, the blockchain’s “trustless” architecture promotes trust in the network without trusting any individual actor (Fairfield, 2005). The consensus of distributed collection of independent computers confirms the true state of the ledger – this is the trust architecture of the blockchain and distributed ledger technology (Werbach, 2018).

Chapter 2

BLOCKCHAIN

The three traditional architectures mentioned above thrive in existence because they have fundamentally evolved based on people’s understanding of trust while shaping how users see the world in turn (Werbach, 2018). If this is true, we should then ask: what kind of reality does a trustless architecture shape for us? Furthermore, in order for us to make a trust leap, we move onto the first level of the trust stack: trusting the idea. What is blockchain, how does it function, and what can it give us?

1. Defining a blockchain

Blockchain and other distributed ledger technologies (DLTs) are technologies enabling parties with no particular trust in each other to exchange any type of digital data on a peer-to-peer basis with fewer or no third parties or intermediaries. Data could represent, for instance, money, insurance policies, contracts, land titles, medical records, birth and marriage certificates, buying and selling goods and services, or any other type of transaction or asset that can be translated into a digital form (Coding Tech, 2018).

Originally proposed in a white paper entitled Bitcoin: A Peer-to-Peer Electronic Cash System in 2008 by Satoshi Nakamoto, a pseudonymous person or group of persons, the basic blockchain concept can be defined quite simply as a shared, decentralized, cryptographically secured, and immutable digital ledger (De Ponteves, 2020). Another quick definition: it is a continuously growing list of records called blocks which are linked and secured using cryptography to form a chain, hence the name blockchain (Narayanan et al., 2016).

1.1. Immutability

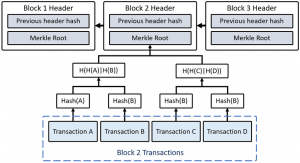

A block contains batches of valid transactions that are hashed and encoded into a Merkle Tree. In very simple terms, a Merkle Tree is a way of structuring data that allows a large body of information to be verified for accuracy both extremely efficiently and quickly . The Merkle Tree is crucial to a blockchain’s security, since it makes it possible to use as little data as possible when processing and verifying transactions. The block is then time-stamped, and is secured by a hashing process. It links together and incorporates the hash of the previous block (Srivastav, 2019).

Figure 5. The architecture of Merkle tree in the blockchain (Chen et al., 2019).

A hash, on the other hand, can be defined as a digital fingerprint to serve as an identifier for anything digital – in this case, a block. Some of the most common hashing functions are MD5, SHA-3 and SHA-256. Developed by the National Security Agency (NSA), SHA-256 consists of 256 bits; 64 characters in hexadecimal. SHA-256 generates an almost-unique signature for a text. For a hash algorithm to be secure, it needs to conform to these 5 requirements (Tel, 2008):

One-way: The content of the item should not be identifiable by that hash

Deterministic: The same item should always generate the same hash

Fast computation

Avalanche Effect: The hash should change with the most minimal alteration of the content or of other determining entries.

Must withstand collisions: That hash combination should be so unlikely and so rare that it shouldn’t be probable for the algorithm to generate collisions. It must also withstand artificial conditions such as hashes generated by hackers.

The previous block’s hash links the blocks together and prevents any block from being altered, or being inserted between two existing blocks. Since it includes the meta-data of the previous block, a link is established between the block and the chain, rendering it unbreakable (Srivastav, 2019). In this way, each subsequent block strengthens the verification of the previous block and hence the entire blockchain. This iterative process confirms the integrity of the previous block, all the way back to the initial block known as the genesis block. Since the blocks are linked in a proper, linear and chronological order, it follows that if one is tampered with, all the subsequent blocks would also be altered (Coding Tech, 2018). This method renders the blockchain tamper-evident, lending to the key attribute of immutability (de Ponteves et al., 2020).

Immutability means that no participant can tamper with a transaction after it has been recorded to the ledger. If a transaction is an error, a new transaction must be used to reverse the error, and both transactions will then be visible. Changing anything prior to the current block means forking the entire chain back to that point. Because every block is linked in a specific sequence, such an action will be rejected without a majority of consensus (de Ponteves et al., 2020). The characteristics of non-repudiation and non-forgeability guarantee that there is a unique and historical version of the records which can be agreed and shared among all participants in a particular network (Nascimento et al., 2019).

1.2. Distributed Ledger

To be clear on the terminology, blockchain is part of the broader family of Distributed Ledger Technology (DLT). DLTs are particular types of databases in which data is recorded, shared and synchronized across a distributed network of computers or participants (Nascimento, 2019). A distributed ledger can be described as a ledger of any transaction or contract supported by a decentralized network from across different locations and people, eliminating the need for a central authority. Although a ledger consists simply of data structured by rules, it matters profoundly to all sorts of transactions because it provides a consensus about facts. Ledgers record the facts underpinning the modern economy. The traditional implementation of a ledger, however, relies entirely on trust in the centralized institutions. Even in the shift from analog to digital ledgers or databases, a database still remains centralized and relies on trust, ergo a digitized ledger is only as reliable as the organization that maintains it. The blockchain is a distributed ledger that does not rely on a trusted central authority to maintain and validate the ledger (Cryptoeconomics, 2017).

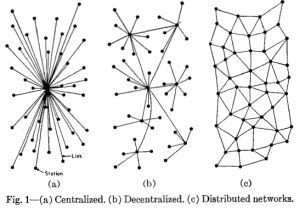

“Decentralization” is one of the words that is used in the cryptoeconomics space most frequently, but it is also one of the words that is perhaps defined most poorly. “Distributed” means not all the processing of the transactions is done in the same place, whereas “decentralized” means that not one single entity has control over all the processing. In this sense, blockchain is both decentralized, and also distributed (Buterin, 2017).

Figure 6. (a) Centralized. (b) Decentralized. (c) Distributed networks (Buterin, 2017).

Why is decentralization useful in the first place? There are generally several arguments raised. Decentralized systems are less likely to fail accidentally because they rely on many separate components, and are therefore fault-tolerant. They are more expensive to attack and destroy or manipulate because they lack sensitive central points that can be attacked at much lower cost than the economic size of the surrounding system. Finally, it is much harder for participants in decentralized systems to collude to act in ways that benefit them at the expense of other participants, whereas the leaderships of corporations and governments collude in ways that benefit themselves but to the disadvantage of less well-coordinated citizens, customers, employees and the general public all the time (Buterin, 2017). There are many different types of blockchains with distinct functionalities and architectures. They can be distinguished according to three functions: who can read, who can execute, and who can validate transactions (Nascimento et al., 2019).

Public or open: When anyone can access a whole blockchain and read its contents.

Close or private: When only authorized entities have access.

Permissionless: If anyone can send and validate transactions.

Permissioned: If entities need to be authorized to execute or validate transactions, or both.

As needed, hybrid blockchains combining different aspects along a continuum can be utilized. In general, four major blockchain types can be distinguished: public permissionless, public permissioned, private permissioned and private permissionless blockchains, as shown in Table 1.

Table 1. Examples of blockchain types (Nascimento et al., 2019)

1.3. Consensus

In a distributed peer-to-peer network, the blockchain is copied across all computers in the network, and all subsequent changes are broadcast across the network to be constantly checked to match up with the other nodes. A blockchain protocol is set, defining the rules that dictate how the computers or nodes in the network should verify new transactions and add them to the blockchain. The protocol employs cryptography, game theory, and economics to create incentives for the nodes to work toward securing the network instead of attacking it for personal gain. If set up correctly, this system can make it extremely difficult and expensive to add false transactions but relatively easy to verify valid ones (Orcutt, 2019).

In a blockchain, everyone can have his or her own copy of a ledger and trust that all those copies remain the same, even without a central administrator or master version (Werbach, 2018). Trust between participants is based on the set of rules that everyone follows to verify, validate and add transactions to the blockchain – the consensus mechanism. We can define a consensus algorithm as the mechanism through which a blockchain network reaches consensus. It ensures that all agents in the system can agree on a single source of truth, even if some agents fail. In other words, a consensus algorithm renders a system fault-tolerant (Arun et al., 2019). The most common implementations of blockchain consensus algorithms are Proof-of-Work (PoW) and Proof-of-Stake (PoS) (Binance Academy, 2020). Satoshi Nakamoto (2008), the creator of Bitcoin, proposed the Proof-of-Work system to coordinate its participants.

1.3.1. Proof-of-Work

In a Proof-of-Work (PoW) system , the validators (referred to as miners) have to verify the transactions grouped in a memory pool called mempool. This transaction verification process is called mining. To include the transaction in the next block, the miner needs to know the cryptographic hash value of the last recorded block, which is hidden from everyone. This hash value must be reference for creating a new block (edChain, 2018). The protocol then sets out conditions for what makes the hash of the new block valid in a cryptographic puzzle that requires immense computing power to solve . After finding a hash that fits the conditions of the puzzle, the miner announces it to the network for the other nodes to verify, and proceeds to add the new block to the chain (edChain, 2018).

The stake, or that which the validator must put forward in order to discourage them from acting dishonestly, is the cost of these machines and the electricity required to run them. In major blockchains, to compete with other miners, high levels of computing power and special hashing hardware is necessary to be in with a chance of producing a valid block. The incentive for using up so much of one’s resources usually consists of the protocol’s native cryptocurrency. Mining yields a significant reward if you successfully add a new block to the blockchain (Werbach, 2018).

Through PoW, Satoshi Nakamoto solved the problem of decentralized time-stamping and double spending. To trust that a coin was not spent twice, there must be a reliable way to track exactly when each transaction happened. On a decentralized network, there is no master clock to which every machine can synchronize. The PoW system therefore imposes consensus on the precise order of transactions. Nodes are agreeing not just on what happened, but in what sequence it happened. The same consensus algorithms that allow each node to have an identical copy of the ledger allow it to perform identical computations, in the same order. That provides what computer scientists call “shared state”, i.e., a picture of the status of the system at any moment (Werbach, 2018).

Each cryptocurrency functions differently according to the design of its creators . Generally, the value of digital money is based on the volume and velocity the digital currency’s payments are running through the ledger, and on the speculative future use of the digital currency.

1.3.2. Proof-of-Stake

In a Proof-of-Stake (PoS) system, there is no concept of miners, specialized hardware, or massive energy consumption. Instead of putting forward an external resource such as electricity or hardware as the stake, the stake is an internal resource – cryptocurrency, a.k.a. crypto tokens. All cryptocurrencies in this network are already created, which means that their number doesn’t change, and that there is no mining required. This eliminates the need to solve a complex cryptographic puzzle, along with the need for a continuous upgrade of hardware and soaring energy costs (Werbach, 2018). Tokens are then acquired by investing in the company running the cryptocurrency in exchange for their native cryptocurrency in a fundraiser called Initial Coin Offering (ICO). ICO is the cryptocurrency industry’s equivalent to an initial public offering (IPO), which is a way by which a company looking to create a new coin, app, or service could raise capital (Frankenfield, 2020).

Rules differ with every protocol, but there is generally a minimum amount of funds to be eligible for staking – they must own and maintain a certain number of native tokens in a specified location to qualify as a validator (Werbach, 2018). The larger the amount of stake and the longer the duration of the stake, the better are the chances of the staker to get transaction validation responsibility. Once tokens have been staked, a selection algorithm chooses one validator to propose a new block for validation. The selection process could have multiple variations, either according to the staking size, the staking age, or through randomization. Selecting a validator is one of the most crucial aspects of a PoS algorithm, and is thus essential to align the selection process with the network’s incentives. As a result, different blockchains employ different methods, which may correspond to the mentioned techniques, or represent a combination of several techniques suitable for the desired purpose (The Bridge, 2020).

Once the validator has been selected, the consensus mechanism adds the new block, which is either according to a pre-defined frequency (Chain-based proof-of-stake), or through a process where other validators vote on the validity of the proposed block (Byzantine-fault-tolerant proof-of-stake). A digital wallet is used to lock up the validator’s funds, and if his block is verified as a valid block by the majority, a proportion of the transaction fees will be received as reward. The more funds the miner has, the more there is to gain. However, in an attempt to cheat by proposing invalid transactions, a portion, or possibly all of the stake could be confiscated or “slashed” for misbehavior. Therefore, similar to PoW, acting honestly is more profitable than acting dishonestly (Binance Academy, 2020).

Proof-of-Work and Proof-of-Stake are the most discussed consensus algorithms, but there are a wide variety of others, each with their own advantages and disadvantages. Other notable consensus mechanisms could be the use of multi-signatures wherein a majority of validators must agree that a transaction is valid, or through the Practical Byzantine Fault Tolerance (PBFT), an algorithm designed to settle disputes among computing nodes when one node in a set of nodes generates different output from the others in the set (Arun et al., 2019).

1.4. Tokenization

It is also important to mention that not all blockchains have a cryptocurrency. Blockchains such as R3’s Corda and IBM’s Fabric are examples of blockchains that do not use tokens, but instead utilizes the main features of blockchain to ensure transaction validity and uniqueness (Sandner, 2017). Furthermore, token types may vary significantly depending on the type of blockchain or distributed ledger. A token, in its simplest terms, is a unit of value – a specific amount of digital resources which a participant can control and reassign control of to someone else. Quite different from its incentive use in Bitcoin, a token can also function as a claim to an asset that is fungible and tradable, such as cash, bonds, securities, stocks, and even cars and houses. The provenance of that asset can be easily tracked on a blockchain by assigning a “token” to it. Tokens can hence serve as proof of the ownership history of the asset, and the ability to divide assets into smaller fractions of ownership enables greater liquidity for that asset (Perez, 2017).

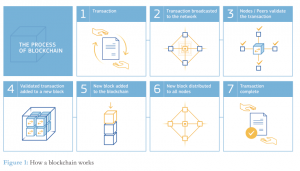

To outline the process of the blockchain, we refer to Figure 7. As transactions are made, they are broadcast to the network to be validated by its nodes or peers. Once there is a consensus on the legitimacy of the contents, the group of transactions is converted to a Merkle Root, and clustered into a block to be hashed and time-stamped along with the hash of the previous block, and then added to the blockchain. The new block is then distributed to all nodes, thus concluding a transaction cycle.

Figure 7. How a blockchain works (Nascimento et al., 2019)

1.5. Smart Contracts

In a traditional information system, contracts are managed by centralized authorities such as insurance companies, agencies and banks. The task of maintaining and enforcing agreements depends heavily on third party organizations, and is often a cause for delay and inefficiency, and effectively creates bottlenecks. The term “smart contract” was first coined by Nick Szabo (1994), where he defined it as a computerized transaction protocol that executes the terms of a contract. In its recent implementation in the release of the Ethereum Project, smart contracts, or “decentralized applications” (Dapps) turned into a notable term in cryptoeconomics as it allowed individuals to create their own contractual agreements that can automatically be executed by the computer code, removing the possibility of downtime, censorship, fraud or third-party interference (McGrath, 2018).

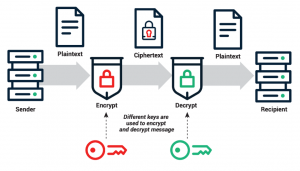

A smart contract, in essence, is a binding agreement between two parties to do or not do something. It is a program that runs within a blockchain that contains a set of rules that constitute an agreement made between two or more parties. When these rules are met, the digital contract executes the transaction. It is similar to a regular application that implements some business rules, only it uses a blockchain as a database (Bekemysheva, 2018). A smart contract can therefore be used to store a business’s terms of agreement (Werbach, 2018). Anyone can examine the source code to understand what exactly the program does, and can know that this code cannot be modified by hackers or viruses because smart contracts rely on blockchain cryptography (Bekemysheva, 2018). Blockchain makes extensive use of Public Key Cryptography (PKC), with the goal of trivially transitioning from one state to another while making reversing the process nearly impossible .

Figure 8. How blockchain cryptography works (Sectigo, 2020)

The first smart contract was built on the Ethereum platform in 2014, and although it experienced some issues of security, scalability and the slow transaction speed, many platforms have since then evolved from its original design. Well into its third generation, smart contract development is now focusing on solving the main critical problems faced by the previous generations such as scalability, interoperability, governance and sustainability (Henten and Windekilde, 2020).

Smart contracts are self-verifying due to its automated nature, are self-enforcing when the rules are met at all stages, and are tamper-proof. Because the contract does not subsist on a central server but on a network of nodes, the execution and output of a contract is validated by each participant to the system, and the distributed ledger guarantees the correct execution of the contract (Destefanis et al., 2018). This enables autonomy between members, not having to be in further contact after a transaction. Being implemented on a blockchain renders the smart contracts immutable, thus assuring that all participants automatically have their fair share (Werbach, 2018).

Blockchain and smart contracts reduce time and cost associated with management and rule enforcement. In place of the time spent, there is instead a much greater amount of exchange that can take place and thus enables a true services economy. It reduces corruption, due to its incorruptible nature, and reduces dependence on centralized organizations. It can deliver certainty, since all possible outcomes are predetermined, and in turn enable parties to know exactly what will happen (Coding Tech, 2018).

2. The Blockchain Trilemma: Decentralized, Scalable and Secure

Before diving into the dynamics of the Trilemma, we broadly define what scalability, security, decentralization mean:

Decentralization: refers to the degree of diversification in ownership, influence and value in the blockchain

Scalability: is the ability of the blockchain to accommodate a higher volume of transactions

Security: is the ability to protect the data held on the blockchain from different attacks or blockchain’s defense against double-spending

Without these three qualities, blockchain projects that aim at a global adoption, will not work. The interplay among the three elements, however, make it a challenge to achieve (ricc, 2020). The trade-off of pure decentralization, for example, is speed. Given similar security parameters, we see that scalability is inversely proportional to decentralization. On the other hand, at constant decentralization, scalability and security are proportional (The Bridge, 2020). The Blockchain Trilemma, its name originally coined by Ethereum founder Vitalik Buterin, states that you will always achieve one of the three main attributes at the expense of others, and that it is impossible to maximize all three properties at the same time. The perfect blockchain, therefore, would be capable of maximizing all three factors, resolving the Trilemma (Prasanna, 2019).

2.1. Decentralization

As mentioned, this is a concept regarding the degree of decentralization, meaning that it is not a binary attribute. Ethereum, for example, is very decentralized, Eos is partially decentralized; while Twitter is not at all decentralized. Decentralization is desirable because it increases the robustness of the system. It makes the network resistant to censorship and thus allows anyone to use the network uplifting the property rights. However, it does come at a cost. If a transaction requires multiple confirmations before reaching consensus, then inherently, it would take longer than if a transaction can be confirmed by a single entity (The Bridge, 2020). Therefore, certain protocols like Bitcoin or Ethereum that use PoW mining to produce new blocks require vast amounts of energy, but also compromises on performance on speed. This can be problematic for use-cases that require high throughput. On the other hand, there are more gridlocks in blockchains with many nodes, so nodes with fewer resources or poor Internet connection paralyzes the network additionally (NeonVest et al., 2018).

2.2. Security

Security is the ability of a blockchain to maintain irrevocability of transactions. It does so by forcing network participants to expend resources to earn rewards. The more resources network participants spend, the more secure the blockchain. It also refers to the level of defensibility a blockchain has against attacks from external resources. Internally, or within the blockchain itself, it is a measure of how resistant the system is to change. Decentralization and security go hand in hand. In many cases, the more nodes there are, the less reliant the network is on a centralized party, and therefore the less risk of having a central point of failure (NeonVest, 2018).

The primary benefit of robust security is that the blockchain is less vulnerable to attack. This is ideal for applications that require sovereign grade security with confidential data, such as financial services. A security-focused blockchain also enables transfers which are quicker and cheaper than traditional value transfers. Since the security of public blockchains comes from network participants, higher security implies higher network effects which are not easy to replicate. Scalability and security are proportional because if the hash rate is higher, the confirmation time is lower, thus increasing scalability (The Bridge, 2020).

2.3. Scalability

Scalability is important for mass adoption. It is the question of how much a blockchain system can sustain (users, use cases, transactions), and whether the system can operate smoothly as demand increases (CertiK, 2019). It essentially boils down to reducing the settlement time to increase the number of transactions per second (TPS) or the throughput of the system. The blockchain’s scalability increases in two ways: the reduction of the number of entities vetting the transactions, which is a compromise on decentralization; or the reduction of block time, which demands reducing difficulty of the network, compromising instead the security of the system. Scalability-focused networks are advantageous in the sense that it allows the network to support a high volume of transaction, and is particularly useful in applications where security is not a prime focus, such is the case in a social messaging application (The Bridge, 2020).

Figure 9. The blockchain trilemma (The Bridge, 2020).

Although there is no actual law stating that the three aspects should be satisfied, development teams are working on different approaches in attempts to solve the Trilemma. It is important to note as well that the Trilemma is simply a model to conceptualize the various challenges facing blockchain technology. As depicted in Figure 8, the Trilemma could be conceptualized as a pyramid . Regardless of the different implementations, it is agreed that it is difficult for any blockchain to effectively achieve decentralization, scalability, and security (CertiK, 2019). The Blockchain Trilemma is most likely unsolvable (Prasanna, 2019), but it does open up an endless number of possibilities as to the approaches in finding the right balance, each tailor-made to the objective that one hopes to achieve.

3. Blockchain Ecosystems Landscape

Blockchain start-ups started to emerge in 2009, though the attention of worldwide investors shifted to blockchain companies only a few years later. Blockchain has gone beyond just financial applications and has gained traction in many other sectors. A new set of players, from industry to academia, governments and supranational organizations, began reflecting on how blockchain could transform significant parts of industry, the economy, and society in the future (Davidson et al., 2016, UK Government Chief Scientific Adviser, 2016). As of 2018, the largest number of blockchain firms was established in the USA, followed by China. Within the EU, the United Kingdom hosts almost half of the blockchain start-ups, followed by Germany, France and Estonia.

Currently, the sectors using blockchain in Europe are the following:

Figure 10. Current sectors using blockchain in Europe (Next Generation Internet, 2019).

The rise of blockchain is characterized by both the sharp growth in startups and by the growing volume of funding going in. Massive funding started in 2014 and rapidly increased to EUR 3.9 billion in 2017 and over EUR 7.4 billion in 2018 (Nascimento, et al., 2019). Blockchain and Distributed Ledger Technologies are now considered one of the technologies to have a profound impact over the next 10 to 15 years (OECD, 2016). Then again, as regards its economic impact, recent analyses give mixed signals. A large majority (77%) of chief information officers acknowledged that their organization had no interest or plans to investigate or develop blockchain systems, and only 1% identified any form of blockchain adoption within their organizations (Furlonger and Kandaswamy, 2018). Also, a high rate of projects is either abandoned or do not achieve a meaningful scale (Deloitte, 2017). When it comes to ICOs, over half of the projects become inactive in four months (Benedetti and Kostovetsky, 2018), while over 80% were identified as scams in 2017 (Satis Group, 2018; Nascimento et al., 2019). Based on these statistics, it shows that blockchain adoption is not a simple affair, and early flocking to the new technology may have attracted funding, but does not necessarily turn out to be transformative. Nevertheless, alongside misgivings concerning the impact of blockchain, its added value, or concrete paths for its widespread deployment, signs of compelling possibilities for its application, and potential growth are becoming worthy of attention (Nascimento et al., 2019).

In this chapter, we’ve understood how blockchain works, what it can do, a bit of what is already being done, and what drives the various approaches to its applications. To conclude, we ask the simple question: why is blockchain so significant when it comes to trust? For one thing, it is the first time in the history of humanity where there is the potential to create a permanent public record of virtually anything, of which no single person or third party has control over, and where we can all reliably agree on the correctness of what is written (Botsman, 2017). Its potential is quite up to our imagination. It is, however, important to state that blockchain does not follow a “one-size-fits-all” model, nor is it a panacea, i.e., a technology that will solve all economic frictions, but is a General-Purpose Technology (GPT), capable of influencing many sectors of the economy simultaneously (Nascimento et al., 2019; Werbach, 2018).

Chapter 3

TRUST AND BLOCKCHAIN

1. The paradoxes of trust in blockchain technology

At this point, the answer to the initial question, “how can ‘blockchain trust’ be defined?” has begun to take shape. To summarize, blockchain trust is a form of distributed trust that banks on the processes of cognitive risk assessment, since it deals with the incentivization of good behavior and the punishment of misbehavior. Monitoring is made possible through the system’s inherent traceability, and ex-ante risk is reduced through a certain degree of predictability offered by its algorithms. The question that remains is if a degree of affective trust still lingers, since the participants on the network, although anonymous, are nevertheless known to be fellow human beings. Calculative trust is typically generalized to trust relationships involving non-volitional trustees (such as a product, electronic agent, or a technology) (Wang and Emurian, 2005; Jones, 2002; Marcella, 1999). However, trust in the non-volitional trustee and its underlying operator is inseparable, i.e., the operators or participants acting on the system do have their own volitions and thus could involve an affective dimension of trust (Li et al., 2008). We will delve deeper into this aspect within this chapter.

Blockchain trust is found to depend on on its four main characteristics: decentralized, immutable, encrypted and algorithmic. The next step is to determine the various implications of each characteristic on trust, and if this kind of trust is indeed relevant to these times – a step closer to answering the question, “can blockchain be trusted?”. A historical analysis of the first blockchains, Bitcoin and Ethereum, was performed along with a literature review focusing on these previously defined characteristics. Encapsulated into four paradoxes, each is presented with its benefits and limitations in the aspect of trust. This section aims to provide the reader a space to slow down the accelerated trust process, also in the attempt to surmount the second level of the trust stack, i.e., trusting the platform.

1.1. Decentralized yet centralized

Centralized trust creates negative externalities even when those at the center remain trustworthy. As the market expands, a purely person-to-person approach breaks down and would necessitate the presence of intermediaries. Intermediation, on the other hand, serves many roles, but also imposes costs, especially when the intermediary is a private company that expects to generate revenue in return for the value it provides. The reconciliation costs create lock-in and value-extraction opportunities for the intermediaries (Werbach, 2018). In this context, Nakamoto saw the dependence on trust as a liability, and thus aimed to eliminate the necessity of involving intermediaries through mathematics (Nakamoto, 2008). A distributed ledger does away with costs from reconciling information between parties that don’t trust each other by replacing those redundant processes with a single record that everyone trusts (Werbach, 2018).

The Internet itself was designed to support trustworthy communication on a distributed network of networks (Werbach, 1997). Users can rely on the network to deliver data even though the system is extremely heterogenous, and no one manages the end-to-end flow of traffic. This was made possible through the use of the Internet Protocol (IP) – a “spanning layer” that provides the definitions that permit translation to occur between a range of services or technologies (Clark, 2005). As long as everyone agrees to support IP, what people do at higher and lower layers is up to them.

While the Internet architecture has garnered much success due to its promotion of tremendous innovation and creative freedom, a problem arose – it allowed for proprietary solutions and the concentration of power at higher levels. In 2017, Facebook generated more than $30 billion in revenue from online activity on their platform, yet the users who actually provided the data that feeds this profit machine received little or none of the financial benefits. While Facebook and other online intermediaries are phenomenally innovative companies that have helped to connect the world and, in many ways, changed life for the better, the power that they have acquired is inherently corrupting. Intermediaries necessarily shape markets to serve their own interests (Werbach, 2018).

Distributed ledger networks operate differently. A cryptocurrency token can be used to monetize ownership value, distributing profit to whom it is due. For example, the Inter Planetary File System (IPFS) offers a blockchain-based distributed cloud-storage technology. Instead of storing files in a particular location, accessible through a uniform resource locator (URL) address, IPFS stores multiple copies of files, in pieces, across many hard drives through the network. It is designed to use its native currency Filecoin to incentivize users to contribute storage space. The token provides the intermediation by establishing incentives on both sides. Those who upload files contribute tokens, and those who store them earn tokens. IPFS, the company, provides the technology, but has no control over the content stored on the network, and the value of the tokens depends on supply and demand (Werbach, 2018).

Removing unnecessary intermediaries can be a significant benefit, but it does not always occur. This is commonly caused by the “Oracle” problem – the conundrum of how to link the digital world with the physical world. For example, if a blockchain records title records of houses, and a ledger entry is to be recorded in the blockchain when the title of a particular house is transferred from A to B, how does the blockchain know if the house has been physically transferred from A to B in the real world? A trusted authority in the physical world is needed to certify that the transaction being recorded on the blockchain has also been executed in reality (Nandwani, 2019).

On the other hand, centralization also has its benefits. In 2013, an update to the Bitcoin Core software accidentally triggered a potentially catastrophic discrepancy within the blockchain (Bitcoin, 2013). The Bitcoin community quickly recognized that the best course of action was to downgrade to the earlier version, destroying the unwanted deviation in the blockchain. The core developers were able to reach consensus in less than an hour through online chat room conversations. A more decentralized community might not have been able to respond in time to stave off a crisis. Therefore, to some degree, trusting a blockchain system means trusting its developer’s judgement (Werbach, 2018).

1.1.4. Consensus Attacks

One of the vulnerabilities already foreseen by Nakamoto is the so-called 51% attack – a phenomenon wherein the majority of the computing power on the network is controlled by an attacker or group of attackers. In such a scenario, the attacker would have enough mining power to intentionally exclude or modify the ordering of transactions, allowing them to halt payments between some or all users (Binance Academy, 2020). They would also be able to reverse transactions that were completed while they were in control of the network, meaning that they could double-spend coins, which is the key incentive to conduct such an attack (Frankenfield, 2019). Upon preventing some or all of the other miners from mining, a mining monopoly would occur, blocking the distribution of the mining power and retaining the hash rate in the hands of a single entity (Binance Academy, 2020).